Product Lines

FET delivers advanced products and integrated solutions across the energy, industrial, and renewable sectors.

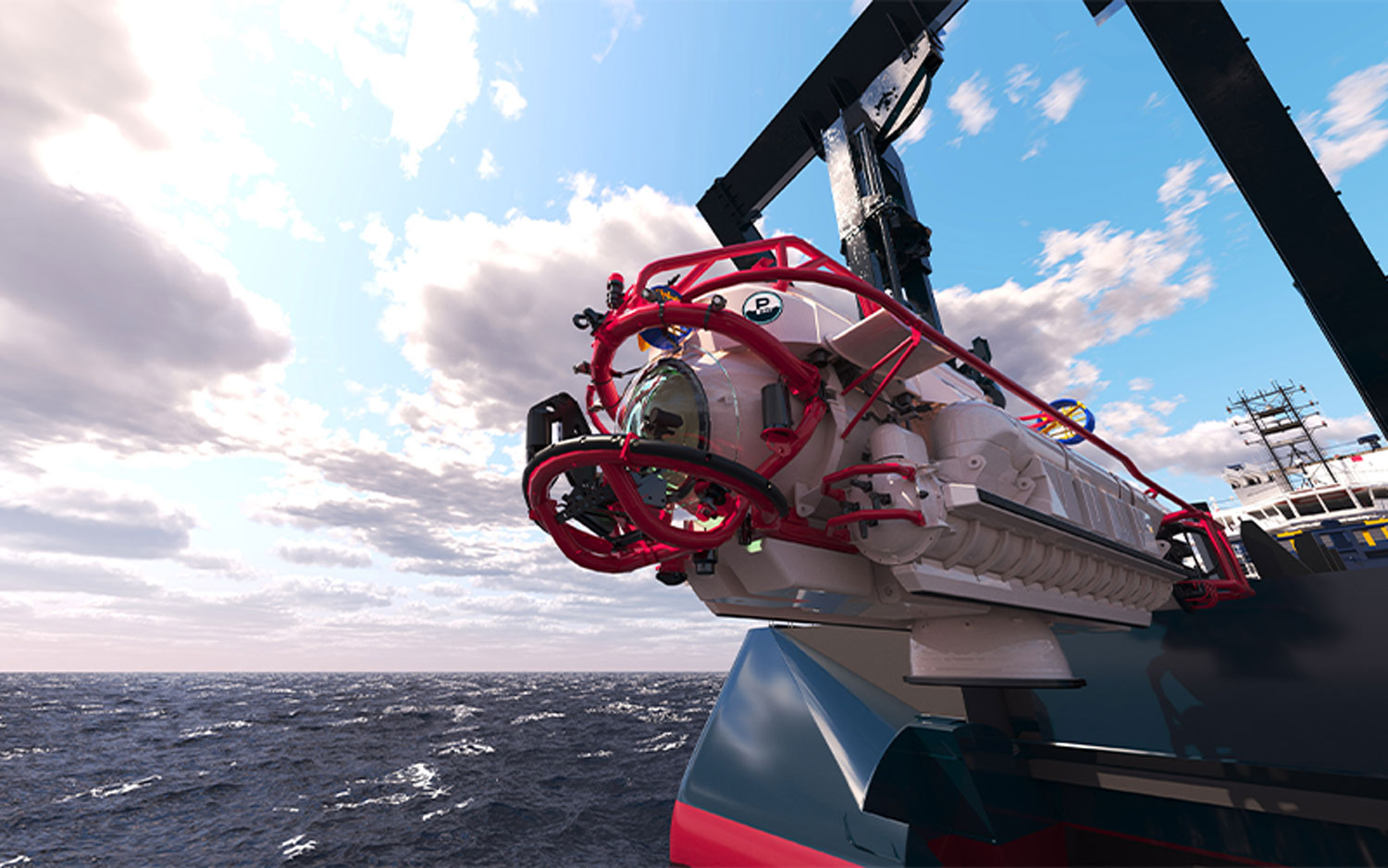

Our diverse product lines span subsea technologies, drilling equipment, production systems, and flow management tools—each engineered to enhance operational efficiency, safety, and sustainability. With a global footprint and a commitment to innovation, FET empowers customers to meet the evolving demands of energy production and infrastructure development.

Applications & Solutions

FET delivers high-performance products and engineered solutions that support critical applications across the energy spectrum.

From pipe handling to artificial lift, subsea operations, and pressure control equipment, our technologies are designed to enhance safety, efficiency, and sustainability. Whether operating onshore or offshore, our global reach and deep expertise help customers meet the evolving demands of oil, gas, industrial, and clean energy sectors. Explore how our solutions drive performance in the most challenging environments.

Brands

FET brings together a portfolio of industry-leading brands that deliver innovative solutions across the energy sector.

From advanced subsea systems and drilling technologies to flow management and production equipment, each brand under the FET umbrella contributes specialized expertise and proven performance. Whether it’s legacy names like Global Tubing, PBV, or Davis-Lynch, our brands are united by a commitment to quality, safety, and operational excellence. Discover the full spectrum of capabilities that drive our customers’ success around the world.

Latest News

Forum Energy Technologies Announces Timing of Fourth Quarter and Full Year 2025 Earnings Conference Call

HOUSTON --(BUSINESS WIRE)--Jan. 30, 2026-- Forum Energy Technologies, Inc. (NYSE: FET) announced today that it will host its fourth quarter and full year 2025 earnings conference call at 10:00 a.m. Central Time on Friday, February 20, 2026. FET will issue a press release reporting its fourth...

Forum Energy Technologies Announces Appointment of The Honorable Leslie A. Beyer to its Board of Directors

HOUSTON --(BUSINESS WIRE)--Jan. 12, 2026-- Forum Energy Technologies, Inc. (NYSE: FET) today announced the appointment of The Honorable Leslie A. Beyer to its Board of Directors. Ms. Beyer will also serve as a member of the Compensation & Human Capital Committee and the Nominating, Governance &...

Forum Energy Technologies to Present at the Investor Summit Virtual Conference

HOUSTON --(BUSINESS WIRE)--Dec. 8, 2025-- Forum Energy Technologies, Inc. (NYSE: FET) announced today that Neal Lux , President and Chief Executive Officer, and Lyle Williams , Executive Vice President and Chief Financial Officer, will present at the Investor Summit Virtual Conference on Tuesday,...